Career in High Finance vs Software Engineering

Subscribe to my newsletter to get notified when I post new content

this last year, i discovered the world of finance. mostly because of my roommate, since he works in investment banking (IB) himself.

now that i think about it more and more, sometimes i feel regret for perhaps not choosing finance as a career instead of software engineering (SWE).

i think there's pros and cons to each, obviously.

btw, when i'm talking about finance, i'm mostly talking about investment banking, PE, or VC. tbh i'm not too well versed in the other areas of finance yet.

also, when i'm talking about SWE, i'm mostly talking about a career in big tech (like facebook, apple, google, etc.). startups are pretty different, and i'll mention them occasionally too.

socializing, networking, people-ing

personality wise, i think i'd fit more into finance lol. from my perspective, those working in finance are usually more on the "social" side. networking is pretty important. and i love talking to others.

personalities in finance generally seem to be more on the social side. these are the people in college who likely would join frats, clubs, etc. in CS this is more rare. people are usually more on the quiet, introverted side. obviously this is a generalization. not all people in finance and CS fit those stereotypes. but there's a reason why those stereotypes exist in the first place.

from what i read on wall street oasis, all roles (analysts, associates, vps, mds, etc.) are heavily involved in working with multiple stakeholders. they are constantly talking to people, whether it be others on their deal team which they've been staffed on, new clients, potential investors, etc.

i think in SWE this opportunity is less, at least in big tech. as an individual contributor (IC), your scope largely falls within your own team. unless your team is client facing, then you rarely interact with those outside your team.

if your team is client facing (lots of times in big tech, these clients are actually internal clients), then you may get these opportunities from time to time. lots of times though, these conversations are not to drive real business impact or value. instead, they're to support issues in ever evolving, extremely complex, legacy systems that fulfill a very niche and boring role in the overall business.

in the startup atmosphere, however, i do think this exists. if you are part of an incubator program like YC, or are working in a startup (100-1000 employees) where your business purpose is more "undefined", then you get more breadth on interacting with others. you may be working with customers directly, talking to leadership more, and directly impacting business direction, etc.

this increase in social interaction also rewards you more ownership of the company's offering. for instance, in big tech, you may be working on a very niche system that's main purpose is to display shipping speeds on a product detail page. in a startup, you may own the entire product detail page. depending on who you are, one may be more rewarding than the other. the team working in big tech is optimizing for highly scalable systems that serve millions of requests a day. the team working in the startup is more product oriented, and will worry about the scalability later.

looking at banking, deal teams are very lean and nimble. they move fast because of the nature of the business. there are a lot less levels of bureaucracy to deal with (with the downside of more toxic leadership). yes, the work may be less meaningful (you may be just moving shapes on a slide to fit another headshot in), but don't think the work in big tech may be any less mundane. you will also be met with endless doc writing, performative initiatives, etc., that drive little to no business value to the organization's overall bottom line. in my eyes, depending on the team you're in, the work in big tech and finance may be equally mind numbing. at least in finance you get the upside of socializing with others and driving more business impact (building pitches that win new clients, creating CIMs that inform investors, etc.)

beyond the social aspects and work structure, another major consideration is compensation and work-life balance.

WLB & money

this topic is kind of interesting, because in big tech, WLB can vastly vary. in high finance though, working 80-100 hour weeks is the standard.

there may be teams at meta, tikok, etc. that are working 996: 9 a.m. to 9 p.m., six days a week (although this is definitely not the majority). however, as the salaries for SWE have become more comparable to high finance, employees may feel more pressure to work more hours to attain better performance ratings or promotion timelines. i'd say lots of people working in big tech work 60 hour weeks, sometimes even 70 if there is an important launch coming up. so if you're a SWE and want to get promoted or high ratings, the WLB for both finance and SWE can become pretty comparable.

in finance though, the salary trajectory is not even comparable. here's some data i found on the web.

Investment Banking Compensation by Level (USD, ~2025)

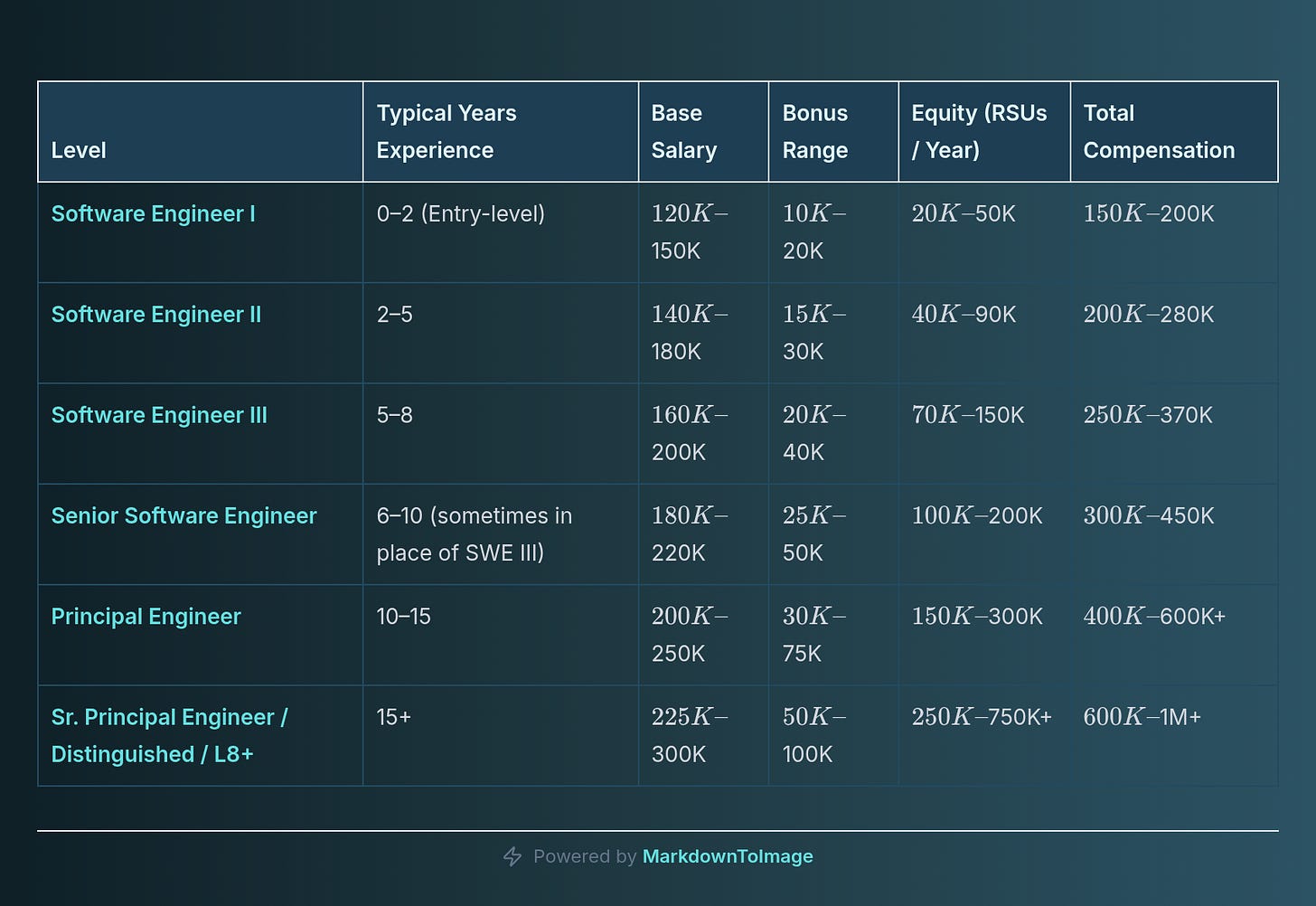

FAANG Software Engineering Compensation by Level (USD, ~2025)

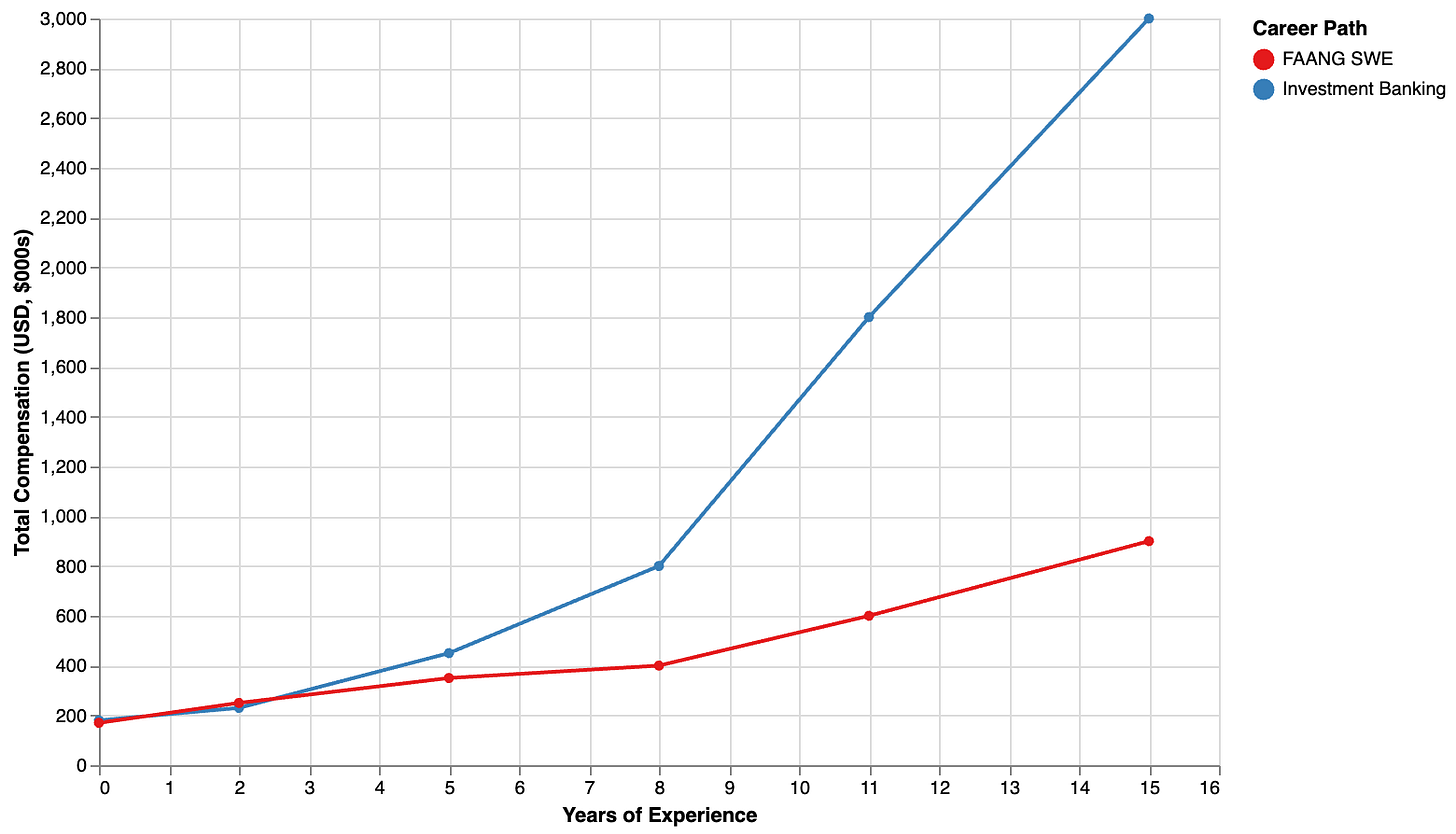

i roughly graphed these numbers on a line graph:

the numbers speak for themselves. career trajectory is kind of incomparable.

it’s important to note though, that the number of opportunities that are available at a senior level in SWE is probably significantly more than IB. so there is a much bigger chance of someone making ~$450k in software engineering than someone getting to $600k-$1m in IB. however, if you are an overachiever, perform well at your role, and know how to play the politics, then i think this is an irrelevant datapoint.

career sustainability & learning opportunity

i do think it's worth noting that it is most likely significantly easier to sustain a career in SWE that IB. SWEs are less likely to be burnt out, and more likely to have a head of hair at the age of 35. if you don't want to grind for a promotion or high rating, and just want to get your work done, then you don't need to grind. you can work a 40 hour week and go home.

moreover, in SWE, if you stay in the same team for a long time, you'll get enough tribal knowledge that the work becomes easy and second nature. knowledge about internal systems and tooling, processes, and workstreams, all become a bible you live by. when someone gives you a task, you know this niche business system so so so well, that you instantly know the possible solutions.

example: you're a sr. engineer working on the tiktok algo team for 10 years. you probably know how that feature works so well. you likely know every single edge case, how the different systems play together, etc. new features for this system are tested and deployed by an internal system, not used elsewhere. you've become the subject matter expert for this system, and all your new learnings are related to this system as well.

however....this is a double edged sword. if you ever have to leave, you may still retain the wisdom that comes with the years of experience, but lose all the practical knowledge that can be applied elsewhere.

don't get me wrong, i'm not saying that there is no learning opportunities in big tech. i've learned more the last 2 years in my career than i did in undergrad. however, the learning curve is logarithmic growth. as you spend more time on the same team, your learning will have diminishing returns. this is why i believe it is very important for engineers to team / firm hop. staying in the same place for too long will hinder your growth as an engineer.

on the other hand though, the work in IB never becomes stale. when one deal ends, a new deal begins. you'll have to ramp up constantly. even 6 years into your career, you'll be working minimum 60-70 hour weeks. you'll likely be staffed on multiple work streams, and have to ramp up about many different topics depending on the company and type of deal (maybe you're working on a new deal for a semiconductor company and have to learn all about that). obviously over time, you'll max out your knowledge about finance, because finance theory doesn't evolve over time, the fundamentals largely remain the same, unlike tech which is ever evolving. at that point, your learning is more business oriented (in terms of what companies are doing and their new strategies).

competition

in terms of getting a job in finance or SWE, i think they've become equally competitive. gone are the days where almost all CS majors could receive a six figure offer right out of college. big tech has tightened hiring. CS graduate volume is at an all time high. technical interviews are becoming more and more intensive in terms of breadth and depth. however, finance is equally as competitive. your school ranking matters-- a lot. you have to be cunning and network before hand to win the favor of your interviewers. your look, perception, and vibe, all matter a lot. both are a battle. depending on who you are, one may be easier to win than the other.

what would i do if i could restart my career?

given all these trade-offs between finance and SWE, it raises an interesting question for me personally.

tbh idk what i'd do if i could restart my career, because it's hard to imagine what the other side could be like.

it's easy to look at the other side which isn't your normal, and become excited about it.

i'm glad i took the path i did so far because i still am pretty satisfied with my career progress so far.

however, i'm definitely a curious koala and want to know what other careers are like.

sometimes i feel mundane, unmotivated, and meaningless lol. even uninterested.

who knows, maybe i'll get an MBA and do a quick stint as an associate just to see what it's like. or maybe i'll just pursue a startup. or maybe i'll let this all go and instead start a cafe or something of that sort.